39+ average mortgage interest rate florida

Web Florida 30-year fixed mortgage rates go up to 674. Web While some areas of Florida boast affordable housing markets homeownership in Florida comes with some risk.

Compare Florida Mortgage And Refinance Rates Bankrate

Web On a 200000 home loan with a fixed rate for 30 years.

. Web The average mortgage interest rate in Florida is 339 just 07 higher than the national average of 337. Florida mortgage rates today are 1 basis point higher than the national average rate of 673. At 6 interest rate 1199 in monthly payments.

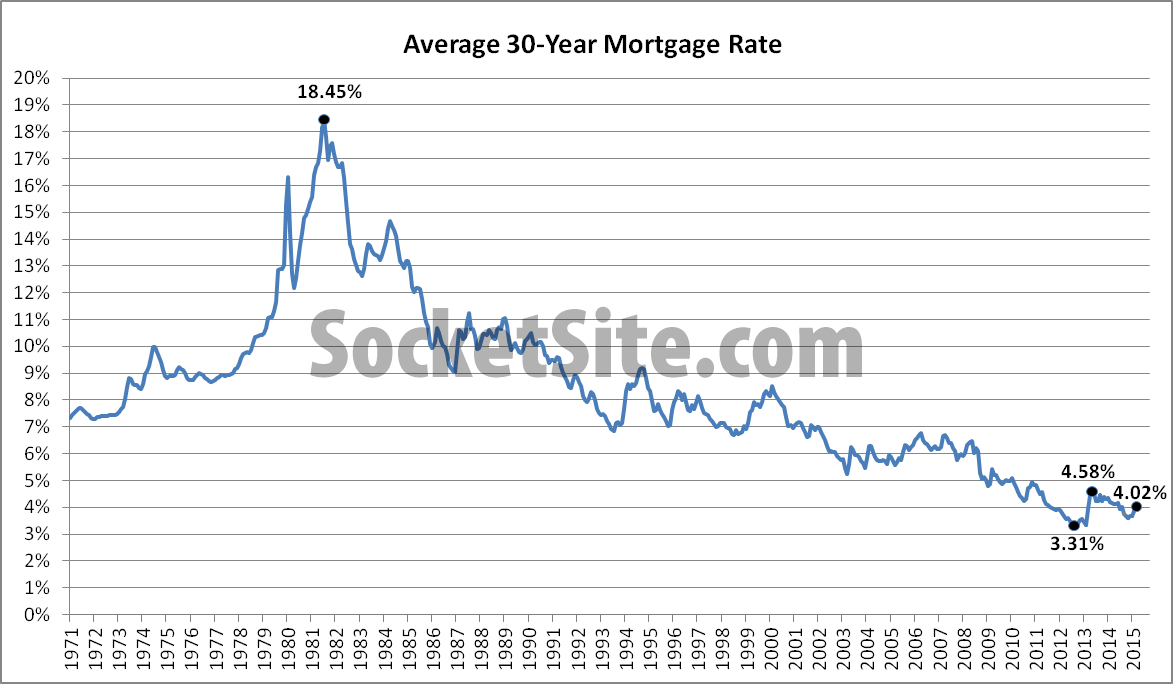

In the last few years Florida mortgage rates are a bit higher than the US. The current average 30-year fixed mortgage rate in Florida increased 5 basis points from 669 to 674. The average long-term rate reached a two-decade high of 708 in the fall as the Federal Reserve continued to raise its key lending rate in a bid to cool the economy.

Save money by comparing rates today. The interest rates for 10-year loans are typically close to the 15-year interest rates but have been a little higher as of late. This weeks average interest rate for a 20-year HELOC is 809 versus 780 last week.

Web Florida Mortgage and Refinance Rates Written by Jeff Ostrowski On Thursday March 02 2023 the national average 30-year fixed mortgage APR is 707. Web Todays national mortgage interest rate trends For today Sunday March 05 2023 the current average 30-year fixed mortgage interest rate is 712 increasing 18 basis points over. Todays Mortgage Rates Mortgage Calculators.

Web Current mortgage rates in Florida are 669 for a 30 year fixed loan 606 for a 15 year fixed loan and 609 for a 5 year ARM. Includes 30-year mortgage and refinance rates for FL. Web Todays mortgage rates in Florida 6375 Rate 655 APR as of 02242023 Choose a different state The mortgage rates shown assume a few basic things including.

Rates can fluctuate by state so its important to know the. The average rate a year ago was 389. Web The actual payment obligation will be greater if taxes and insurance are included.

Web Historic mortgage rates for Florida. Getting ready to buy a home. You have very good credit a FICO Score of 740 and a specific down payment amount for your loan type.

1 Your loan is for a single-family home as your primary. Web While the Federal Reserve doesnt directly dictate mortgage rates the outlook for Fed rate hikes matters a great dealnbsp. Web Current rates in Orlando Florida are 699 for a 30 year fixed loan 636 for 15 year fixed loan and 622 for a 5 year ARM.

At 3 interest rate 843 in monthly payments. At the current interest rate a 25000 20. But Florida ranks in the bottom half of states with an average borrower credit score of 728 six points lower than the national average of 734.

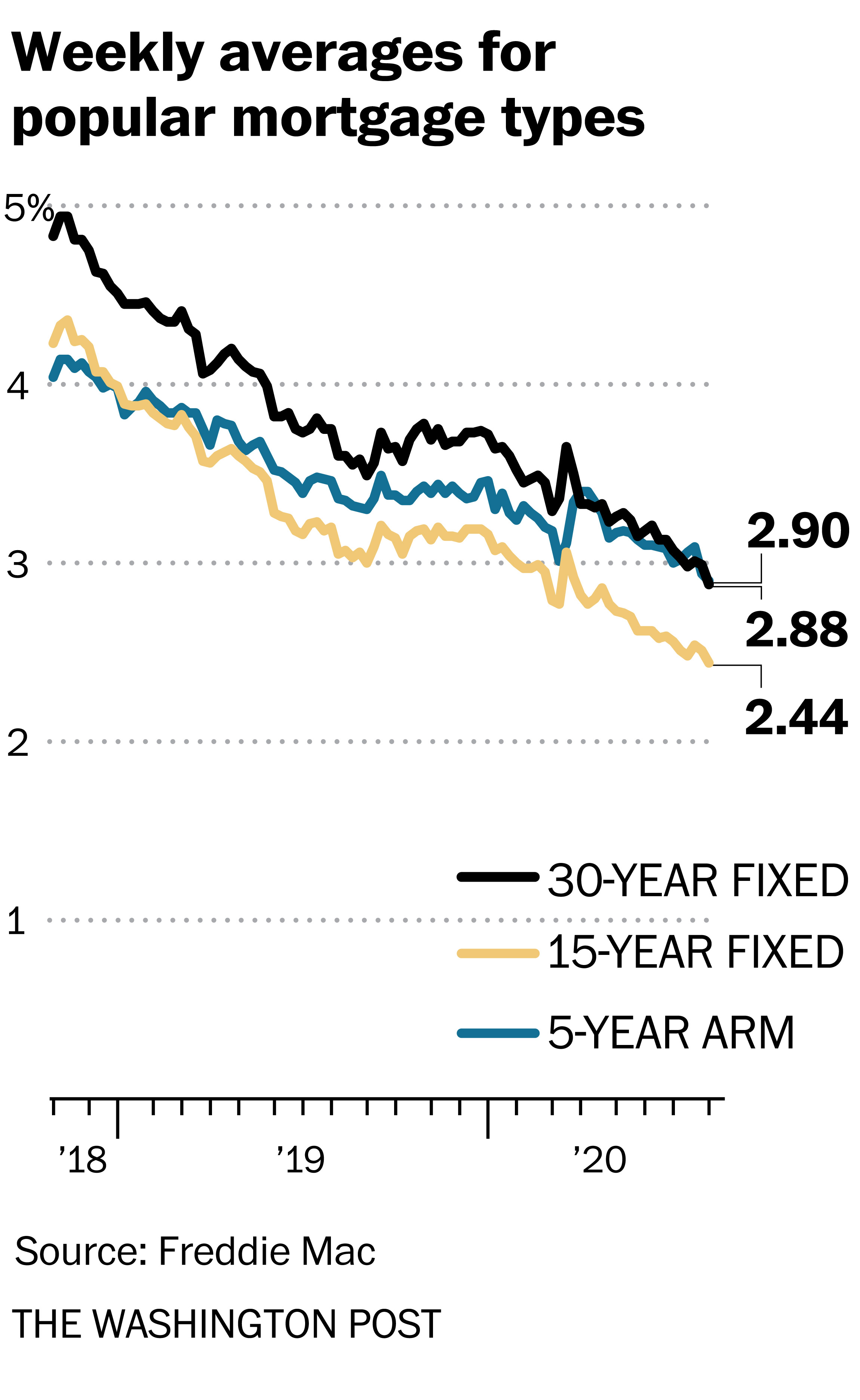

Census Bureau Florida has the third-largest population of any of the 50 states with a sizable mortgage market to match. Web Shorter-term fixed-rate loan interest rates in Florida are somewhat lower with 20-year rates at about 345 and 15-year rates just under 3. Many factors go into the interest rate that borrowers pay including their credit score.

Web The average mortgage payment is 3048 on 30-year fixed mortgage and 3976 on a 15-year fixed mortgage. By looking at the average mortgage rates in Florida since 2010 you can see trends for 30-year fixed mortgages 15-year fixed mortgages and 71 adjustable. Web 20-year HELOC Rates.

Web Todays mortgage rates in Florida are 6854 for a 30-year fixed 5979 for a 15-year fixed and 6992 for a 5-year adjustable-rate mortgage ARM. However Floridas 080 average effective property tax rate is less than the national mark. More information on rates and product details.

Data provided by 3rd party Icanbuy LLC. However a more accurate measure of what the typical American spends on their. In the days and weeks leading up to almost every Fed.

Web The average interest rate for a metro Orlando homebuyers mortgage hit 695 in October more than double the average of 3 from a year prior according to Orlando Regional Realtor Association. Louis Fed Median Monthly Homeownership Costs. Web Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate rose to 65 from 632 last week.

At 8 interest rate 1468 in monthly payments. At 4 interest rate 955 in monthly payments. That compares to the 52-week low of 514.

Web Todays mortgage rates in Florida are 6954 for a 30-year fixed 6008 for a 15-year fixed and 7013 for a 5-year adjustable-rate mortgage ARM. As of June 8 2022 mortgage rates averaged the following in Florida according to Bankrate data. The state has some of the highest foreclosure rates and homeowners insurance costs in the country.

The national average 30-year fixed. Web What Are the Current Mortgage Rates in Florida. Web See current mortgage rates in Florida from top lenders.

Lower Mortgage Rates No Relief For Us Home Sales Wolf Street

Today S Florida Mortgage And Refinance Rates Credit Karma

Article Real Estate Center

Mortgage Rates Pulled Down To Lowest Levels In History The Washington Post

30 Year Mortgage Rates Hit Lowest Point In 50 Year History Inman

Current Mortgage Rates Florida Mortgage Expert

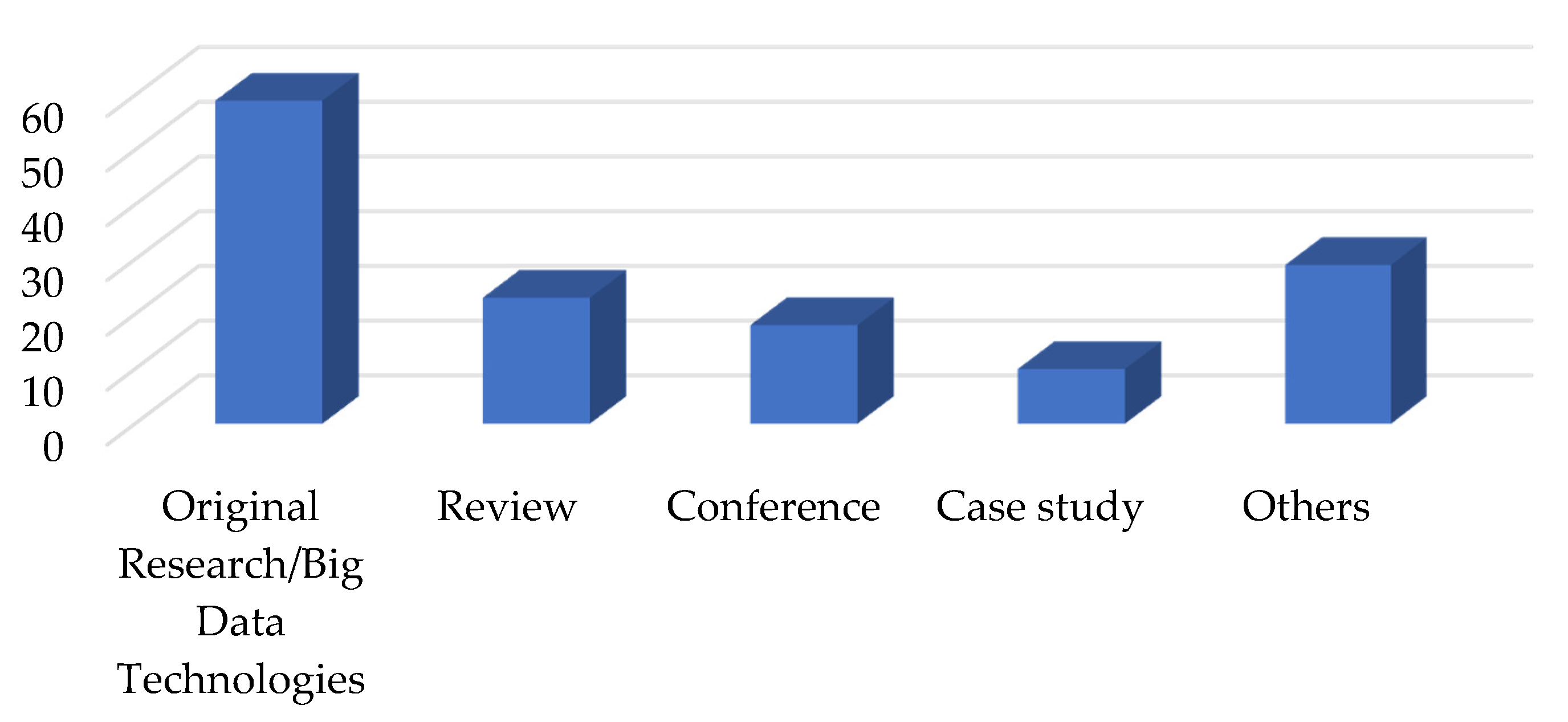

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

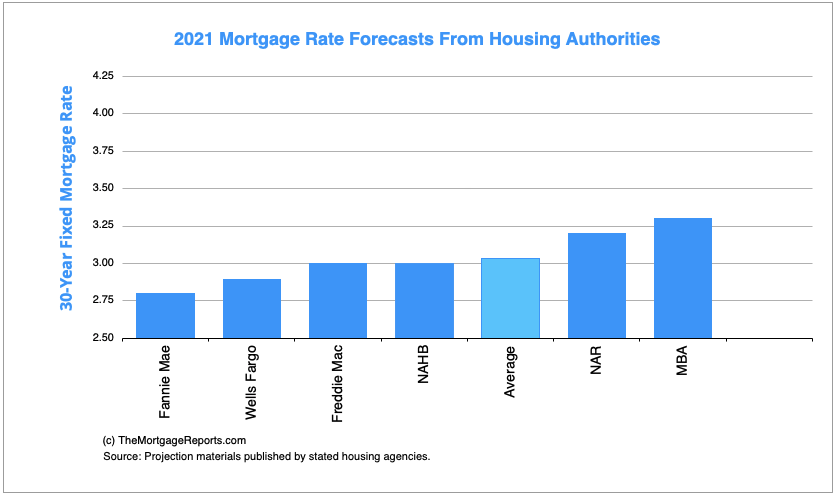

Forecast Will The 2020 Election Change Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

![]()

Florida Mortgage Refi Rates Today S Fl Home Loans Interest Com

30 Year Mortgage Rate Over 4 Percent For First Time In 2015

Barndominium Construction Loan Valuable Facts You Should Know

Current Florida Mortgage Rates Forbes Advisor

Current Mortgage Rates Florida Mortgage Expert

Macroeconomic Models With Heterogeneous Agents And Housing Document Gale Academic Onefile

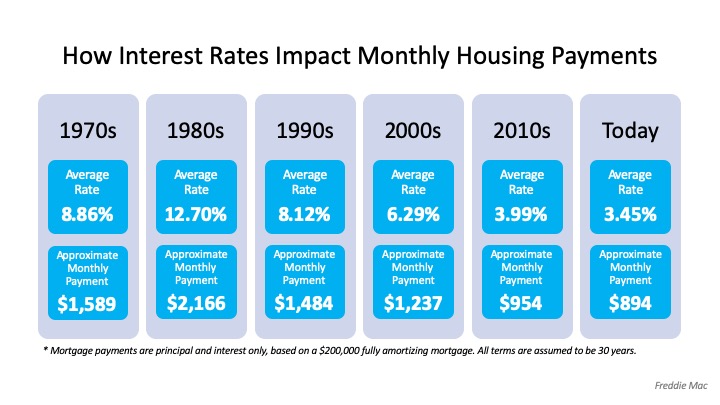

How Interest Rates Can Impact Your Monthly Housing Payments Cape Gazette

India Herald 082714 By India Herald Issuu

Lower Mortgage Rates No Relief For Us Home Sales Wolf Street